Beschreibung

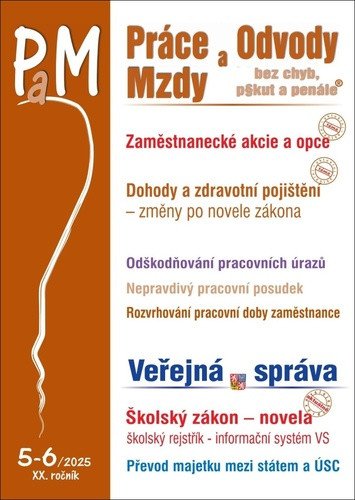

Steuerliche Behandlung von Mitarbeiteraktien und -optionen ab 2025 – Die Gesetzesänderung führt Änderungen bei der Besteuerung von Arbeitnehmereinkünften aus dem Erwerb von Mitarbeiteraktien ein. Die bestehende Stundungsregelung für die Besteuerung von Mitarbeiteraktien, die am 1. Januar 2024 eingeführt wurde, kann nur noch freiwillig angewendet werden. Arbeitgeber können nun entscheiden, ob sie freiwillig nach der ab dem 1. Januar 2024 geltenden gesetzlichen Regelung vorgehen möchten. Die Publikation umfasst: Das monatliche Magazin bietet aktuelle Beiträge, ergänzt durch praktische Beispiele und aktuelle Rechtsprechung. Es ist in folgende Rubriken unterteilt: Aktuelles, Arbeitsrecht, Fehler und Strafen, Rechtsprechung, Geschäftsreisen, Firmenwagen, Beiträge, Öffentliche Verwaltung, Vertragsmuster, Arbeitgeberausgaben, Management ... – Steuerliche Behandlung von Mitarbeiteraktien und -optionen ab 2025 – Vereinbarungen und Krankenversicherung – Änderungen – Hilft eine längere Probezeit? - Kurzfristige Beschäftigung - Entschädigung bei Arbeitsunfällen - Der Urlaub steht vor der Tür - Spenden für Betroffene von Überschwemmungen - Studenten, Teilzeitjobs im Ausland und Krankenversicherung - Lösungen für die Nutzung von Firmenfahrzeugen für Dienstreisen ab 2025 - Bildungsgesetz – Änderung - Neue Regelung zur Übertragung von Eigentum zwischen Staat und Kommunen

Information

Author: Autorengruppe

Language: Czech

Publication date: 2. Mai 2025

Manufacturer: PORADCE sro

Genres: Sozialwissenschaften, Bücher, Fach- und technische Literatur, Gesetz

Type: Bücher - Taschenbuch

Pages: 103

ISBN/EAN: 9771801993532