Description

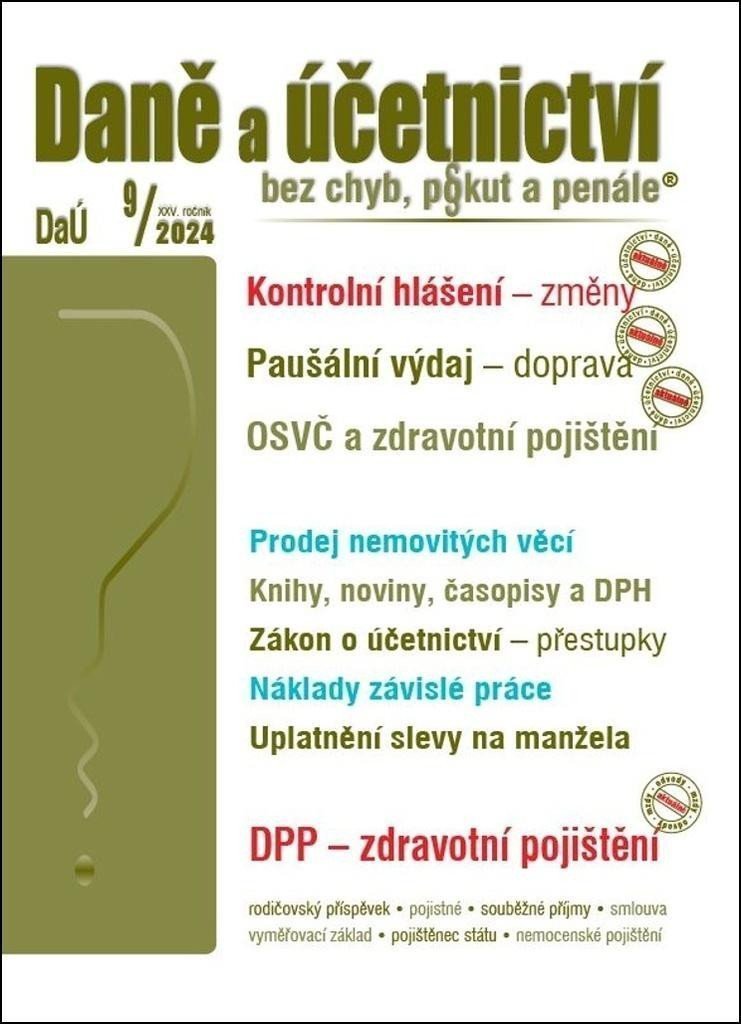

In connection with the amendment to the VAT Act, two reduced VAT rates have been abolished. As a result, adjustments have been made to the electronic form of the control report and the VAT return. What do the adjustments to the forms consist of? ***** • Delivery of books, newspapers, magazines, and VAT When applying VAT to the delivery of books, newspapers, magazines, and other publications, it is necessary to proceed according to the relevant provisions of the VAT Act. The delivery of books, newspapers, magazines, and other publications in printed form or in the form of an audio recording of their content on a tangible medium is understood for VAT purposes as the delivery of goods. However, if books, newspapers, magazines, and other publications are provided to customers in electronic form, it is considered a service for VAT purposes. The amendment to the VAT Act has introduced changes in tax rates effective from January 1, 2024, and established a tax exemption with the right to deduct tax on the delivery of books and the provision of similar services. The article explains the currently applicable basic rules for applying VAT when providing books, newspapers, magazines, and other publications both as goods and as services, using examples. The impacts of the changes in tax rates effective from January 1, 2024, on the delivery of newspapers are explained in more detail,…

Information

Publication date: June 24, 2024

Manufacturer: PORADCE s. r. o.

Genres: Law, Books, Specialized and technical literature, Social sciences

Type: Books - paperback

Pages: 79

ISBN/EAN: 9771214322479